Client On-Boarding Fee

We are required to undertake due diligence on all clients that we represent in a conveyancing transaction. This must be completed before we can begin working on any transaction. We refer to this process as ‘client on-boarding’ and it includes an on-line identity check along with an anti-money laundering check. We use a third party called InfoTrack to benefit from their digital onboarding technology, which helps speed up the conveyancing process, and through their platform simplify our charging structure.

This process is required in every transaction and therefore we charge you a one-off client on-boarding admin fee which includes VAT. The cost is ‘per person’ and is in addition to any of the cost estimates below. The cost is £19 (inclusive of VAT).

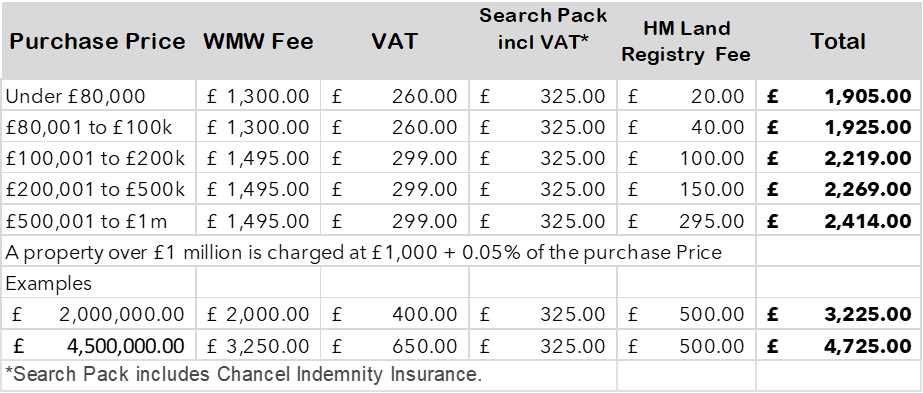

Residential Purchase Price List

Cost Estimate

As each property transaction is different, it is not possible to give an exact price at the outset. The following provides an indication of what to expect in a standard transaction.

Wason Male & Wagland (WMW)

Unlike some other firms, we do not automatically charge you an additional fee if you are purchasing a leasehold residential property, such as a flat.

It is not our intention to add on additional fees once the transaction is near completion. If the particular property being purchased results in the possibility of additional fees, these will be declared to you at the time they arise and your agreement to progress will be sought.

Scope

The WMW fee includes all work within the scope of a standard residential purchase transaction. This generally includes:

- Reviewing the draft contract and other documentation received from the seller’s solicitor.

- Investigating the property title deeds.

- Commissioning and investigating searches, and then raising enquiries with the seller’s solicitor.

- Reviewing replies given by the seller to pre-contract enquiries.

- Drafting the transfer deed.

- Advising the buyer in respect of the mortgage offer (if applicable).

- Preparing a Report on Title, comprising a summary of findings from the preceding investigations.

- Exchange of contracts on your behalf, attending to completion formalities including transferring funds to complete the purchase.

- Submission of your SDLT return to HMRC and payment on your behalf (or Land Tax if the property is in Wales).

- Registration of your ownership at HM Land Registry, and the mortgage (if applicable).

- For a leasehold property, carrying out other post-completion matters with the managing agents/landlord.

The WMW fee excludes any work which falls outside the scope of a standard residential purchase transaction. We will always advise you about any additional costs/complications as they arise during the transaction. Any such charges will need to be authorised by you before they are incurred.

Anticipated Disbursements

We mainly use a third party called InfoTrack to provide the necessary documentation and information needed for the transaction. Rather than charge separate fees for each disbursement, such as Bankruptcy Searches, Priority Searches pre-completion, Lender Handbook Search and Lawyer Checker, we charge a one-off ‘document admin fee’ that covers the cost of all these disbursements. The cost of this fee is detailed below.

The following is a list of typical disbursements for a residential purchase.

For residential leasehold purchases various charges may be applicable depending on the terms of the lease and/or fees charged by the landlord/management company. We will provide you with an estimate of such fees following receipt of title and supporting documents from the seller’s solicitors and we will always advise you of any additional charges as the circumstances arise during the transaction. However, there is a generic list of possible additional costs at the end of this document that you may want to refer to.

Your proposed lender (if any) may use an online portal to manage mortgage related communications with our firm. Some online portals carry no charge for the use of the portal, whereas others do. An additional disbursement of £25 + VAT for use of the LMS portal will apply if your matter completes with a lender who use the portal.

Stamp Duty Land Tax

The SDLT calculation depends on the value of your property and your individual circumstances. You can calculate the amount you will need to pay by using HMRC’s website or, if the property is located in Wales, by using the Welsh Revenue Authority’s website. The WMW fee includes the calculation, administration, and payment of SDLT on your behalf.

Timescale

The UK national average for a conveyancing transaction is 12-16 weeks. At WMW, we aim to complete a freehold transaction between 8 – 12 weeks from initial instructions.

Leasehold transactions can take longer, as we are more reliant on third parties, such as the landlord or management company, to produce information. We estimate that a leasehold transaction will take between 10–14 weeks from initial instructions.

We will keep you updated throughout the transaction to ensure you are aware of any changes to the timescale.

Please contact navinder@wmw-solicitors.co.uk for further information.

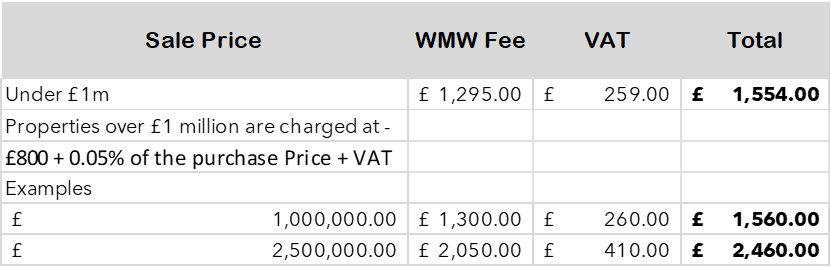

Residential Sale Price List

Cost Estimate

Each transaction will be subject to the client on-boarding fees detailed above.

As each property transaction is different, it is not possible to give an exact price at the outset. The following provides an indication of what to expect.

With a leasehold residential sale there are likely to be several additional fees that arise due to the nature of the transaction, such as the cost of obtaining a management pack from the managing agents. These costs are detailed in the disbursements section.

Scope

The WMW fee includes all work within the scope of a standard residential sale transaction. This generally includes:

- Taking your instructions and providing initial advice.

- Assisting you with the completion of the protocol forms.

- Obtaining the property title deeds.

- Drafting the contract and supplying the buyer’s solicitors with any supporting information relating to the property.

- Liaising with you and any third parties to deal with any pre-exchange enquiries raised by the buyers.

- Obtaining planning documentation if required.

- Giving you advice on all documents and information received.

- Obtaining a redemption figure if there is a mortgage charge on the property.

- Approving the transfer deed.

- All work associated with a standard residential completion, including the redemption of any existing mortgages and payment of estate agent fees if so instructed.

- For leaseholds, the calculation of apportionment of the service charge and ground rent.

- Where appropriate assisting the buyer’s solicitors with any requisitions raised by HM Land Registry during the registration process.

The WMW fee excludes any work which falls outside the scope of a standard residential sale transaction. Additional costs may arise in the following circumstances:

- A defect in title which requires remedying prior to completion.

- The preparation of additional documents ancillary to the main transaction.

- If unforeseen complications arise.

- For leaseholds, if the assignment requires the grant of a new lease or a staircasing/shared ownership transaction.

We will always advise you about any additional costs/complications as they arise during the transaction. Any additional charges will need to be authorised by you before they are incurred.

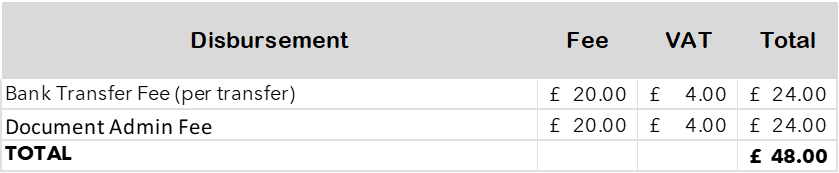

Anticipated Disbursements

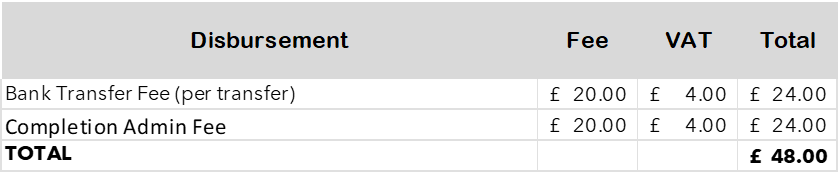

Disbursements are fees paid to third parties which are incidental to the main conveyancing transaction. The Cost Estimate above excludes such disbursements.

We mainly use a third party called InfoTrack to provide the necessary documentation and information needed for the transaction. Rather than charge separate fees for each disbursement, such Land Registry Title Documentation, we charge a one-off ‘completion admin fee’ that covers the cost of all the InfoTrack disbursements. The cost of this fee is detailed below.

The following is a list of typical disbursements for a residential sale transaction.

For leaseholds, a management pack is usually required from the management company. The prices charged by the management company vary but are generally between £200-£400.

Additional disbursements may apply if indemnity policies are required. The premiums for indemnity policies depend on the risk required to be covered and the value of the property.

We will always ensure you are advised of any additional charges as the circumstances arise during the transaction.

Timescale

The UK national average for a conveyancing transaction is 12-16 weeks. At WMW, we aim to complete a freehold transaction between 8 – 12 weeks from initial instructions.

Leasehold transactions can take longer, as we are more reliant on third parties, such as the landlord or management company, to produce information. We estimate that a leasehold transaction will take between 10–14 weeks from initial instructions.

We will keep you updated throughout the transaction to ensure you are aware of any changes to the timescale.

Please contact navinder@wmw-solicitors.co.uk for further information.

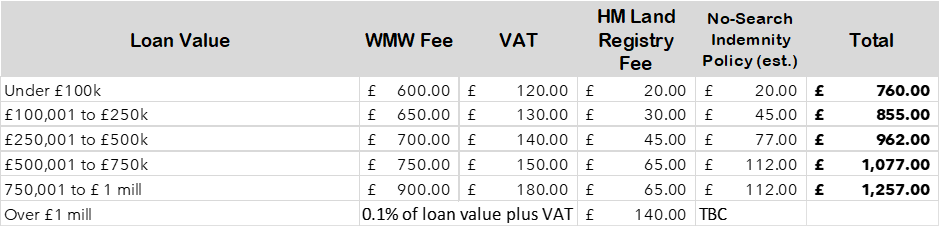

Remortgage Price List

Cost Estimate

Scope

The WMW fee includes all work within the scope of a standard residential remortgage. This may include:

- Ensuring the property’s title is suitable security for the new lender.

- Overseeing the repayment of the old mortgage.

- Arranging the execution of the mortgage Deed.

- Removing the registered charge from the registered title at HM Land Registry

- Registering the new charge in favour of the new lender at HM Land Registry.

The WMW fee excludes any work which falls outside the scope of a standard residential remortgage. Additional costs may arise if, for example, a transfer of equity is required.

If there needs to be a transfer of equity, namely adding or removing another party from/to the title deeds, an additional fee of £350 plus VAT (totals £420) will be charged in addition to the above fees.

We will always advise you about any additional costs/complications as they arise during the transaction. Any additional charges will need to be authorised by you before they are incurred.

When remortgaging, many lenders will accept a no-search indemnity insurance policy in place of searches. The amount quoted for this policy in the Cost Estimate above is an estimate, to be confirmed once the full information is known.

Some lenders do not accept indemnity insurance and a full search pack will be required at a cost of £325 (inclusive of VAT). No-search indemnity insurance will be used instead of a full search pack wherever possible.

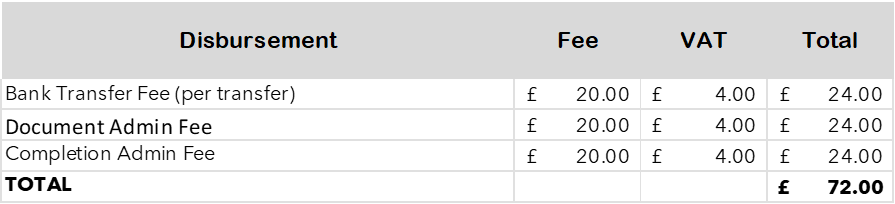

Anticipated Disbursements

Disbursements are fees paid to third parties which are incidental to the main conveyancing transaction. The Cost Estimate above excludes such disbursements.

We mainly use a third party called InfoTrack to provide the necessary documentation and information needed for the transaction. Rather than charge separate fees for each disbursement, such Land Registry Title Documentation, we charge a one-off ‘completion admin fee’ that covers the cost of all the InfoTrack disbursements.

InfoTrack also provide necessary documentation, such as Bankruptcy Searches, Priority Searches pre-completion, Lender Handbook Search and Lawyer Checker. These are necessary in every transaction and therefore we charge a one-off ‘document admin fee’ that covers the cost of all these particular disbursements. The cost of this fee is detailed below.

The cost of these fees is detailed below.

The following table provides an indication of the typical disbursements for a remortgage.

Your proposed lender (if any) may use an online portal to manage mortgage related communications with our firm. Some online portals carry no charge for the use of the portal, whereas others do. An additional disbursement of £25 + VAT for use of the LMS portal will apply if your matter completes with a lender who use the portal.

Stamp Duty Land Tax

If you are remortgaging while also transferring equity, you may be liable for SDLT.

The SDLT calculation depends on the value of your property and your individual circumstances. You can calculate the amount you will need to pay by using HMRC’s website or, if the property is located in Wales, by using the Welsh Revenue Authority’s website. The WMW fee includes the calculation, administration, and payment of SDLT on your behalf.

Timescale

At WMW, we aim to complete a remortgage conveyance between 4–6 weeks from initial instructions.However,the process depends on several external factors such as how quickly third parties provide the information required to progress.

We will keep you updated throughout the transaction to ensure you are aware of any changes to the timescale.

Please contact navinder@wmw-solicitors.co.uk for further information.

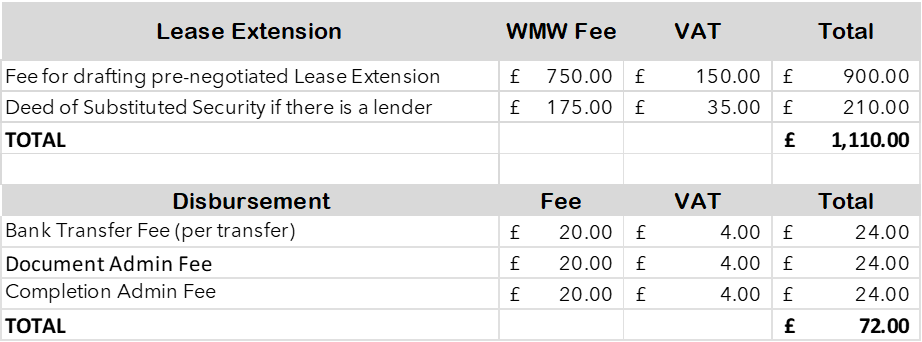

Lease Extension Price List

If you are buying or selling a leasehold property you may wish to, or may be required to, extend the term of the lease. You will probably also be required to pay the Landlord’s legal costs and Landlord’s surveyor’s costs in the transaction. We will clarify this with you on instruction.

Cost Estimate

If you are required to serve a s.42 Notice we will need to speak to one of our legal team for a breakdown of the likely costs.

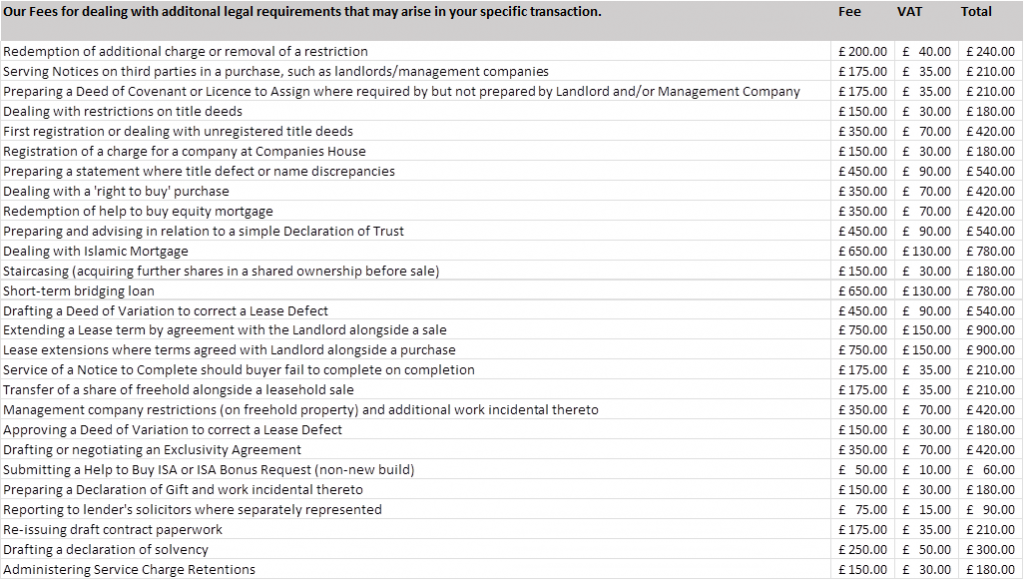

We have provided a comprehensive list of our standard fees and the usual disbursements that occur in a typical transaction. There are occasions where the specific nature of the transaction results in additional charges or disbursements. Please refer below to our non-exhaustive list of additional costs that may be charged.

Please contact bill@wmw-solicitors.co.uk for further information.

List of additional fees

New Build Fee: Where the matter is a Newbuild an additional fee will be added which will be based on the requirements of the matter. Please speak with one of our solicitors for further information.